san francisco gross receipts tax ordinance

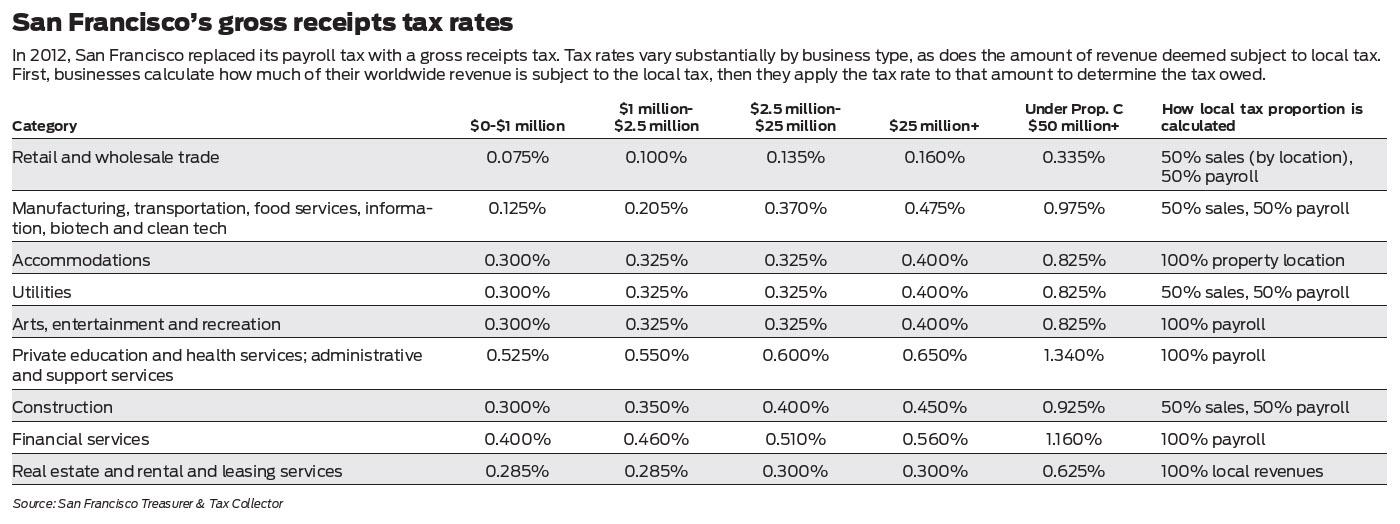

THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. On November 6 2012 San Francisco residents approved Proposition E the Gross Receipts Tax Ordinance instituting a new gross receipts tax to replace the Citys 15 payroll tax.

Business And Tax Regulations Code

In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Tax.

. To the gross receipts tax under the Existing GRT Ordinance11 Among other examples a person is considered engaging in business in San Francisco if that person or any employee. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES.

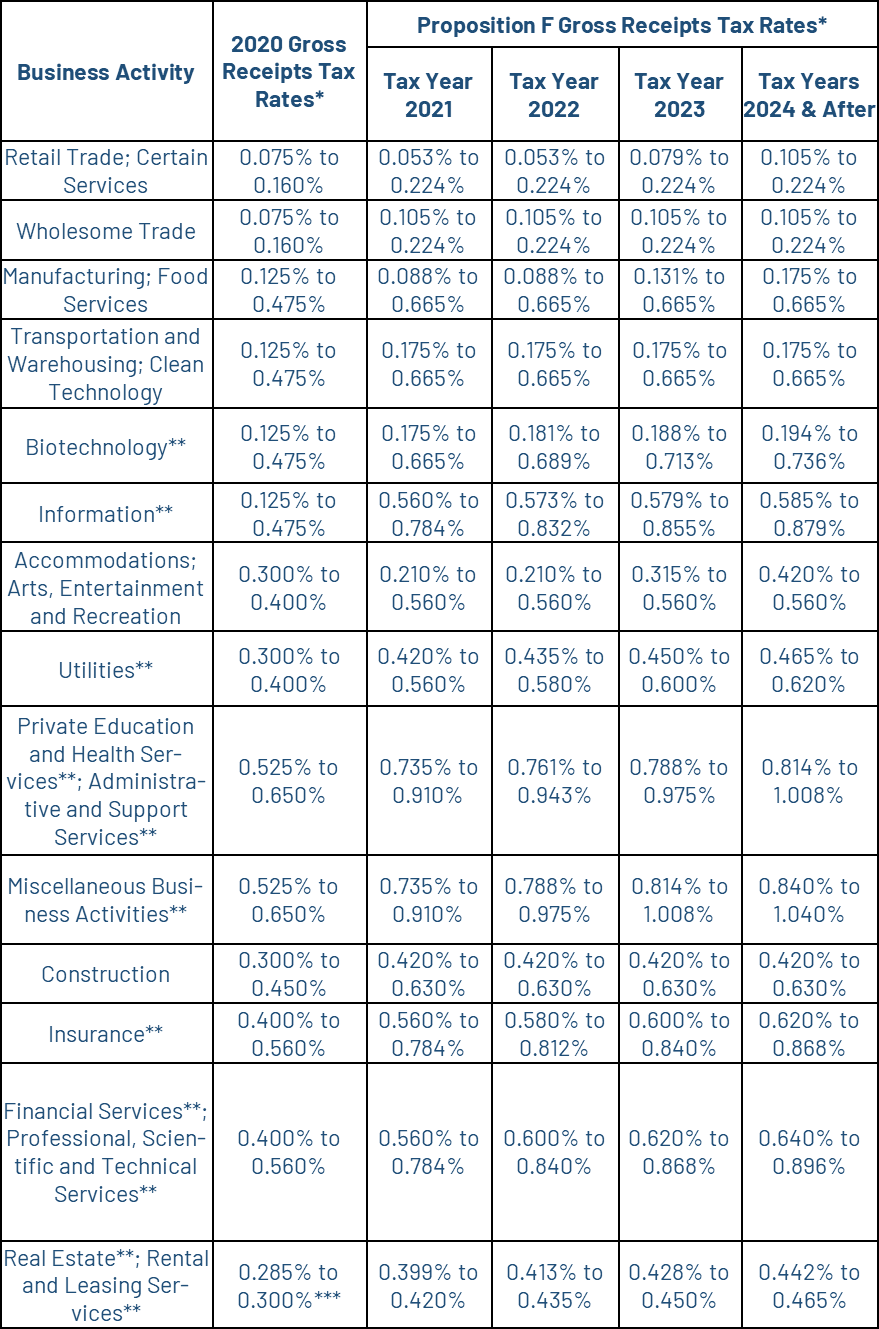

GROSS RECEIPTS TAX APPLICABLE TO REAL ESTATE AND RENTAL AND LEASING SERVICES. Proposition F overhauls the citys gross receipts tax regime including increasing gross receipts tax rates for all businesses when the measure is fully implemented. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

On June 5 2018 San Francisco voters passed Proposition C which imposes a new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse. 2 Gross Receipts Tax. THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999.

THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. A new gross receipts tax of 1 percent on revenues a business receives from leasing warehouse space in San Francisco and 35 percent on revenues a business receives from leasing certain. The approved ordinance also created the overpaid executive administrative office tax OEAOT to be imposed on San Francisco-based businesses including businesses with under 1.

A The gross receipts tax rates applicable to the business activities of real. The Homelessness Gross Receipts Tax effective January 1 2019 imposes an additional gross receipts tax of 0175 to 069 on combined taxable gross receipts over 50 million. 1 Proposition E San Francisco Gross Receipts Tax Ordinance Article 12-A-1 Gross Receipts Tax Ordinance approved by voters on November 6 2012.

THE SAN FRANCISCO SUNSHINE ORDINANCE OF 1999. CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts.

CELL PHONES PAGERS AND SIMILAR SOUND-PRODUCING ELECTRICAL DEVICES. Overpaid Executive Tax OE The Overpaid Executive Tax also referred to as the Overpaid Executive Gross Receipts Tax was approved by San Francisco voters on November 3.

2022 San Francisco Tax Deadlines

A New Dimension For Llcs In California

Gross Receipts Tax And Other Indirect Pmba

Annual Business Tax Returns 2021 Treasurer Tax Collector

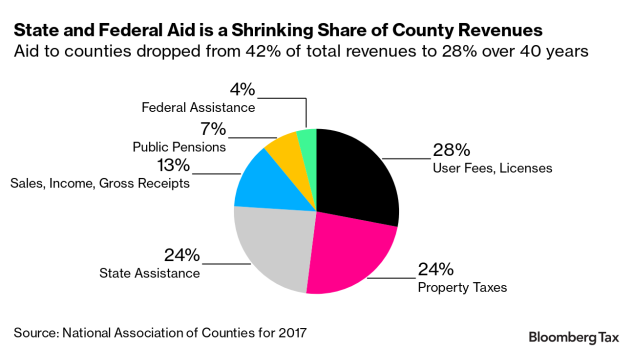

Revenue Squeeze Pushes Cities Counties To Get Creative On Taxes

Prop C Sf S Early Care And Education Ordinance Reuben Junius Rose Llp

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

2022 San Francisco Tax Deadlines

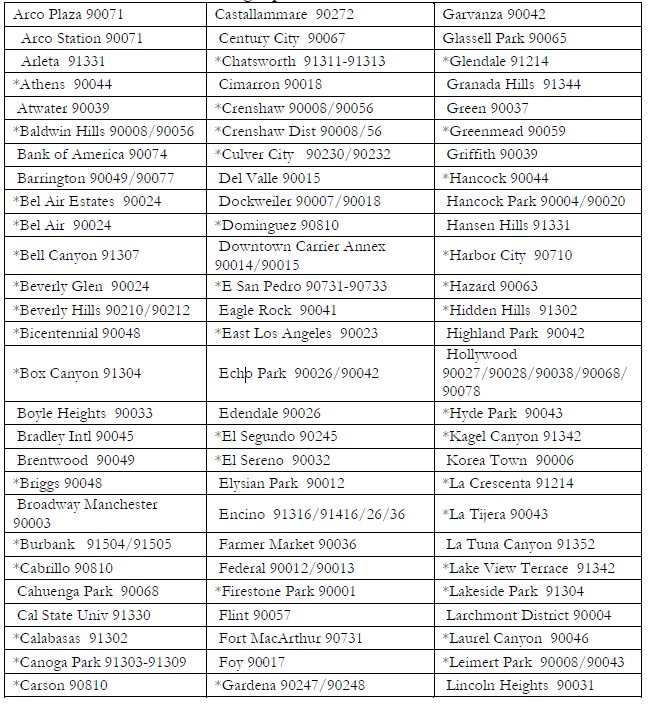

Special Considerations For Los Angeles Business Taxes Filing Due On March 2 2015 Corporate Tax United States

Gross Receipts Tax Gr Treasurer Tax Collector

Working From Home Can Save On Gross Receipts Taxes Grt Topia

Homelessness Gross Receipts Tax

Overpaid Executive Gross Receipts Tax Approved Jones Day

Measure U Gross Receipts Business Tax Richmond Ca Official Website

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

Gross Receipts Tax In The Digital Age Law 4 Small Business P C L4sb

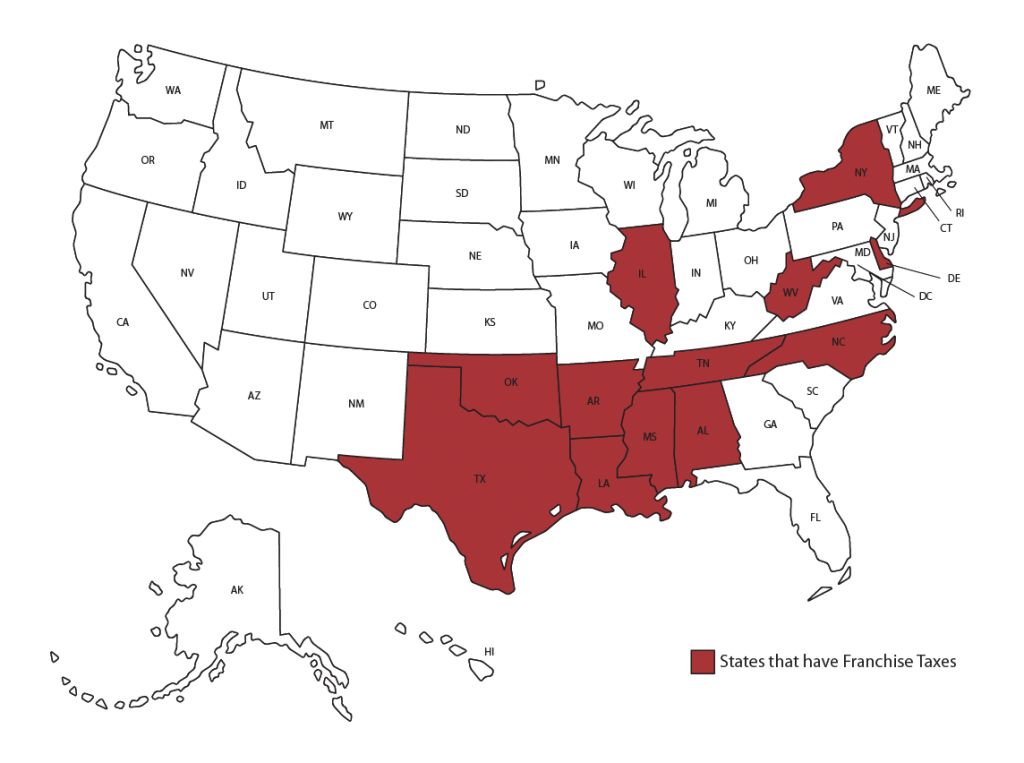

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes